It's jobs day, a dovish Powell disappoints, and oil surges.

Payrolls

Today's employment report is expected to show that U.S. employers added just under 200,000 new positions in February, with the unemployment rate holding at 6.3% and the annual growth rate of earnings ticking slightly lower. Already this week we have seen disappointments from both ADP employment data and weekly jobless claims, so this number at 8:30 a.m. Eastern Time will be closely watched for any signs of a recovery.

Powell

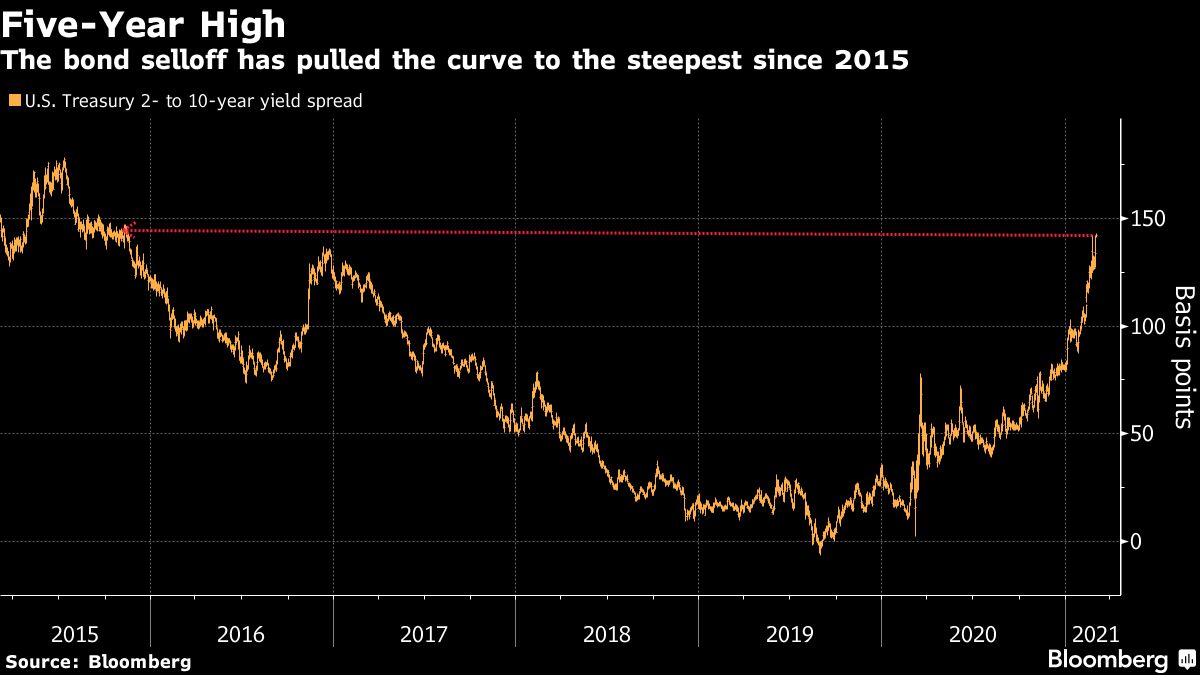

Fed Chair Jerome Powell left bond investors underwhelmed by his comments on the Treasury market yesterday. While he did reaffirm the central bank's commitment to remaining accommodative, he did not try to rein in the selloff. This lack of comment only served to fuel further selling yesterday, with the yield on the 10-year Treasury at 1.55% this morning. The Fed is not the only central bank having to deal with market expectations, with a majority of economists surveyed by Bloomberg saying they expect the European Central Bank to step up the pace of purchases to counter rising bond yields.

Pricing power

Crude soared after yesterday's surprise announcement from OPEC and its allies that oil production would not be increased in April as previously expected. A barrel of West Texas Intermediate for delivery next month was trading over $65 a barrel this morning. JPMorgan Chase & Co. described the outcome of the meeting as "the most bullish we could have expected" for crude. Most of Wall Street's top banks hiked their forecasts for oil prices in the wake of the decision.

Markets slip

Global equites remain under pressure with the continued volatility in the bond market keeping investors cautious. Overnight the MSCI Asia Pacific Index slipped 0.8% while Japan's Topix index closed 0.6% higher. In Europe the Stoxx 600 Index was 0.4% lower at 5:50 a.m. with energy companies getting a lift from the surge in oil prices. S&P 500 futures pointed to a small drop at the open, gold held under $1,700 an ounce and Bitcoin struggled.

Coming up...

The U.S. trade balance for January accompanies the payrolls report at 8:30 a.m. The Baker Hughes rig count is at 1:00 p.m. and consumer credit numbers are at 3:00 p.m. The Senate debate on the stimulus bill continues today, with voting expected over the weekend before the legislation is sent back to the House. Big Lots Inc. is among the companies reporting earnings and CERAWeek concludes.

What we've been reading

This is what's caught our eye over the last 24 hours.

And finally, here’s what Joe's interested in this morning

In the post-Great Financial Crisis period, episodes of market volatility have followed a five-step sequence.

1. Something triggers a stock market selloff.

2. Yields go down.

3. There's a growth scare or fears of a recession.

4. The Fed intervenes in some way and calms the market down.

5. A value investor goes on TV and whines about how the Fed needs to "take off the training wheels."

Okay, the value investor has a point. It's really not in the Fed's mandate to make sure stocks keep going up. However, in the type of slow growth environment that we saw between March 2009 and March 2020, with incomes so meager, you could make the argument that any tightening of financial conditions really did threaten real economic growth, and therefore threatened the Fed's mandate -- forcing it to intervene.

Now we're experiencing another bout of volatility, but this time it's different. Yields are actually going up. And there's no growth scare. In fact if anything, the "scare" (such as it were) is that growth will be much faster than the Fed is expecting. Faster growth really isn't something to worry about, but it does explain why companies whose fortunes are directly linked to GDP (banks and oil companies) have been surging, while companies whose fortunes don't hinge on whether GDP grows 3% or 8% in a year -- like Tesla or Virgin Galactic -- have been tanking.

And then finally the other big difference is that this Fed just doesn't seem concerned about soothing the market right now. In his interview yesterday by the Wall Street Journal, Powell was given numerous opportunities to lean against the recent rise in yields and he never took the bait. He just stuck to the same message he's had for months: The Fed won't hike until we see maximum employment and sees a sustained rise in inflation and that's that. It's not that complicated.

What's key though is that in the current economic environment, market volatility isn't perceived to be an economic threat the way it was over the last decade. We're probably on the verge of another $1.9 trillion dollars in stimulus soon and there's a tidal wave of reopening spending set to wash over the economy. With this kind of economic tailwind, what does it really matter if ARKK is down for the year and the S&P is flat and the 10-year yield is at 1.50%? It's not that big of a deal in this context.

The Fed could probably push back on some of the market action if it really wanted to, maybe by talking more about how it's concerned by the rate rise or some nod to more bond purchases at the long end. But again, since the market volatility is no real threat to the economic fundamentals yet it simply does not need to.

Things could change of course. The economic fundamentals could sputter (no stimulus? unexpected pandemic setback?) or the market selloff could get much more serious. But at the moment, it looks we're getting the stock market that people always say they want: One where the Fed doesn't have to worry about every tick down so much, because robust economic fundamentals have severed (or at least diminished) the link between volatility and poor growth. Enjoy it folks!

Joe Weisenthal is an editor at Bloomberg.

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

"five" - Google News

March 05, 2021 at 06:31PM

https://ift.tt/3ecNAm4

Five Things You Need to Know to Start Your Day - Bloomberg

"five" - Google News

https://ift.tt/2YnPDf8

https://ift.tt/2SxXq6o

No comments:

Post a Comment